The Real Gold Standard

Discover Your Investment

Potential with Gold

Long-Term Performance

International Trading Capacity

Tax Benefits for UK Residents

Great! 4.7 out of 5

GOLD

PERFORMANCE

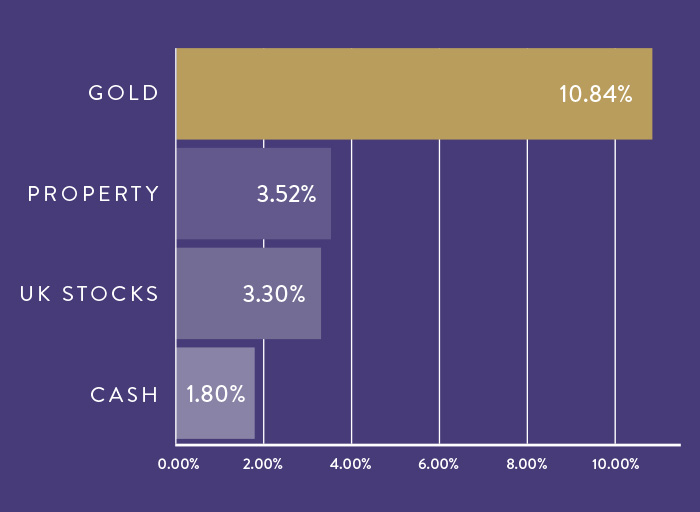

AVERAGE ANNUAL PERCENTAGE CHANGE OVER 20 YEARS*

| Comparisons | Gold | Stocks | Property | Bonds |

|---|---|---|---|---|

| CGT exempt for UK residents |

|

- | - | - |

| VAT exempt for UK residents |

|

- | - | - |

| Physical ownership available |

|

- |

|

- |

| Quick and easy liquidity |

|

|

- |

|

| 24/7 Market access |

|

|

- | - |

| Risk of bankruptcy |

|

|

|

|

Why Gold?

Long-Term Performance

Gold is a highly liquid asset that preserves its value over time, delivering long-term returns and improving diversification.

International Trading Capacity

Gold is a popular means of investment with a thriving global secondary market.

Tax Benefits for UK Residents

Our gold bullion coins and bars are free from Value Added Tax (VAT) and gold bullion coins are exempt from Capital Gains Tax (CGT) for UK residents.

Learn with our AcademyComparing the Different

Types of Gold

Explore the benefits of each of our gold investment products.

Comparing the Different

|

Gold Coins |

Gold Bars |

Digital Gold |

|---|---|---|---|

| Investments available from £25 | - | - | Yes |

| Capital Gains Tax (CGT) exempt for UK residents | CGT exemption applies | - | - |

| Value Added Tax (VAT) exempt for UK residents | VAT exempt | VAT exempt | VAT exempt |

| Vault storage available | Available | Available | Available |

| Delivery available | Available | Available | - |

| Sell back service | Yes | Yes | Yes |

| Design options | Yes | Yes | - |

| Physical or digital ownership | Physical ownership | Physical ownership | Physically-backed digital ownership |

Let’s See What Works for You!

The Royal Mint’s gold investment calculator is designed to assist you in selecting the gold package that best suits your needs. Simply select your preferences and discover the ideal gold investment option for your budget.

Investment

What’s Happening in the Market?

March 13, 2025

Investment

Download our Free Guide to Gold

March 13, 2025

Investment

Coins vs. Bars vs. Digital

March 1 2025

Prefer to Speak to Someone About

Your Gold Investment Options?

Get price alerts delivered directly to

your inbox X

Enter your email preferences below.

*Price based alerts will stop once the price is reached, percent based alerts will reset to the current meta price once triggered i.e and alert set for a 5% increase once triggered will reset to the new precious metal price plus 5%.

Fetching the Latest Prices

Book an appointment with us X

Free gold investment guide X

We have developed a comprehensive investment guide to assist our customers in navigating the world of gold investment. This guide is offered free of charge and encompasses all the essential information you require to make an informed investment decision with The Royal Mint.

Sign up to our investment newsletterX

Receive the latest market insights from our experts

Get alerted to the latest bullion coin and bar launches

Don’t miss out on access to our bullion offers and prize draws